India'''s booming subscriber base for telecom services has fueled the demand for telecom equipment in the fiscal 2008-09 with the country's telecom equipment industry crossing the $ 4 billion mark at a y-o-y growth of 24 %.

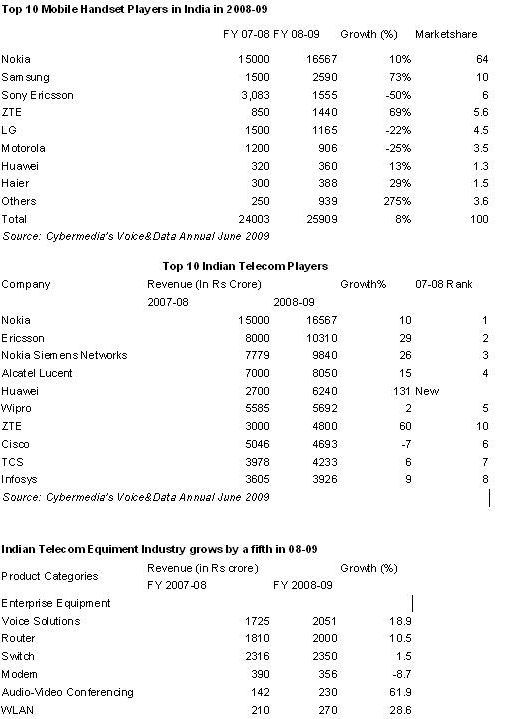

Voice&Data's latest findings as part of its annual V&D 100 survey reveals that Revenue-wise Nokia attained the top spot with revenues of Rs 16,567 crore followed by Ericsson with revenues of Rs 10,310 crore, Nokia Siemens Networks (NSN) with revenues of Rs 9,848 crore, Alcatel-Lucent with revenues of Rs ,8050 crore, Huawei with revenues of Rs 6,240 crore, in that order and ZTE at number 7 with revenues of Rs 4,800 crore. Cisco was the only company to report a drop in revenues from the Indian market with revenues reaching Rs 4,693 crore to reach eighth spot in the rankings. Wipro, TCS and Infosys registered revenues of Rs 5,692 crore, Rs 4,233 crore and Rs 3,926 to claim No 6, 9 and 10 position respectively (the revenues considered are only from the sales of telecom software).

Remarkably, the year belonged to emergence of Chinese companies as formidable players in the Indian telecom gear market with Huawei managing to more than double its revenues and ZTE posting 60 % growth.

Category-wise, the phones category including CDMA, GSM as well as fixed line terminals witnessed a slowed down growth rate of 6% with Rs 26,669 crore. The segment saw growth coming from semi-urban and rural areas which are mainly dominated by entry-level phones and presence of low cost Chinese phones. Mobile phone sales grew by 7.9 % but fixedline terminals saw a drop in revenues to Rs 700 crore as compared to Rs 1,200 crore a year ago.

Samsung followed Nokia in the handset market with revenues of Rs 2,590 crore and a market share of 10 %. Next to follow was Sony Ericsson with revenue of Rs 1,555 crore and market share of 6 %. ZTE occupied the number 4 spot in the handset market with revenues of Rs 1,440 crore, Haier occupied the number 8 spot with revenues of Rs 388 crore and Huawei with revenues of Rs 360 crore attained the number 9 spot. LG was at number 5 with Rs 1165 crore at 22 % decline in sales. Sony Ericsson saw a decline of about 50 % in sales while sales of Motorola too declined by 25 % to Rs 906 crore.

Telecom software recorded revenues of Rs 25,152 crore with prominent players in the space being Tech Mahindra, TCS, Wipro, Infosys, Sasken and Subex.

“We've seen this before: in a downturn, telecom gains, as businesses deploy cost-saving tech", said Prasanto K Roy, chief editor of Voice&Data. “In the last downturn, IP telephony got a boost. This time, it's video-conferencing, including high-spend areas such as telepresence.”

The complete survey findings will be published in Voice & Data's upcoming issue for June.

|