The enterprise application software market in Asia Pacific (excluding Japan) grew by 6.5 % in 2013 to reach US$12.6 billion, slightly lower growth than in 2012, according to the latest worldwide software market share results from Gartner, Inc.

“The software industry is in the middle of a multiyear cyclical transition as organizations are focusing investment on technologies to support existing systems, in order to maintain competitiveness, while still taking advantage of cloud/subscription-based pricing where it makes sense to grow and advance the business,” said Gartner research director Yanna Dharmasthira.

Application software markets include enterprise resource planning (ERP), office suites, customer relationship management (CRM), business intelligence (BI), supply chain management (SCM), enterprise content management (ECM), digital content creation (DCC), web conferencing and project and portfolio management (PPM) software.

Countries in the region showed mixed performance. Australia stood out as the fastest growing market among the mature Asia Pacific countries driven by growth in CRM investments, BI and analytics, new spending on SaaS and cloud based deployments, as well as upgrades and improvements to continue the modernisation of established, mission critical software. Application software revenue in Australia totaled US$3.4 billion (A$3.5 billion) and grew 7.7 % from 2012.

Meanwhile, China continued to face moderating growth due to slowing domestic and export market demand. In China, application software revenue reached US$3.1 billion (RMB 19.1 billion), an increase of 5.9 % over 2012.

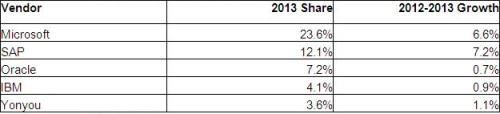

The top five vendors in Asia Pacific (excluding Japan) remained stable, but their success and performance in various countries greatly varied. ERP, CRM, office suites, and BI and analytics were the largest software markets. These software segments also dominated in Australia, however, CRM played a bigger role in terms of share.

Top 5 Enterprise Application Software Vendors, Asia Pacific (excluding Japan), 2012-2013

Source: Gartner (March 2014)

In Australia, the ranking is the same except for Salesforce.com in fifth place. The variation in the top five vendors in Australia compared to Asia Pacific overall reflects the differences in technology priorities between mature and emerging markets. ERP is still the dominant software revenue contributor in many emerging countries, where local vendors played stronger roles, such as in China. |