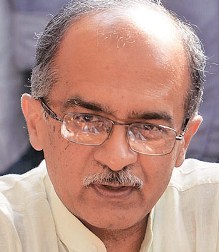

Scam-tainted Maxis may not be able to sell its Spectrum in Aircel to RCOM as leading lawyer and activist Prashant Bhushan, who exposed 2G Scam, has filed an Intervention Application (IA) in the Supreme Court seeking attachment of Spectrum allotted to Aircel.

“.……In these facts and circumstances, the petitioners respectfully pray that your Lordships may be pleased to direct the Respondents Union of India, CBI and ED to not allow M/s Maxis to sell stake/equity or spectrum of allotted to M/s Aircel, and direct the Respondents to attach the property and spectrum allotted to M/s Aircel,” said Mr Bhushan in the petition.

Earlier, he had written letters to CBI and ED to attach Spectrum so that Maxis is not allowed to exit the market by selling Spectrum to Airtel and RCom for thousands of crore.

In his IA, Prashant Bhushan has pointed out that CBI and ED has not taken any action against Aircel/Maxis after filing detailed chargesheet against the company and its Malaysian owner Ananda Krishnan among others. “The ED has also filed cases against them and has attached properties of former telecom minister. However, it is strange and disturbing that while properties of former telecom minister and Sun Direct TV are being attached, but the assets of Aircel/Maxis in India have not been attached. This has happened despite the fact that Maxis and its owner have evaded summons issued by the Special Court and have not appeared before the Court.”

The main asset of the company Aircel/Maxis is the Spectrum. Spectrum, which is a precious natural resource belonging to the people of India, has been allotted to Aircel/Maxis by the Government. Today, the company is attempting to quickly sell-off its allotted Spectrum to Reliance Communications (RCOM) for thousands of crores, Prashant Bhushan has pointed out.

“Petitioners respectfully submit that the Spectrum is the real asset held by Aircel and the same needs to be attached immediately.”

Facts of the case:

About Aircel:

Aircel is owned by Malaysia-based Maxis Communications, which holds 74% equity stake and the rest 26% is with Sindya Securities and Investments Ltd. Maxis had earlier informed Malaysian stock exchanges that itowned 99.7% stake in Aircel.

CBI charge sheet against Maxis and its promoter Ananda Krishnan

On August 29, 2014, the CBI filed charge sheet in the 2G special court saying that Mr. Dayanidhi Maran had entered into a criminal conspiracy with T. Ananda Krishnan (owner of Malaysian company Maxis), andcoerced the original promoter of telecom company Aircel to sell his shares to Ananda Krishnan in lieu of investments by Maxis Group into Sun Direct TV Pvt. Ltd (owned by Maran brothers).

Charge sheet was filed against Dayanidhi Maran, Kalanidhi Maran; T. Ananda Krishnan, Ralph Marshall (executive of the Maxis Group), and four firms - Maxis Communication Berhad, Astro All Asia Network PLC, Sun Direct TV Pvt. Ltd., South Asia Entertainment Holdings, Mauritius.

Charge sheet was filed under section 120-B (criminal conspiracy) of IPC and the Prevention of Corruption Act

Ananda Krishnan, Maxis and Ralph Marshall do not comply with court summons

On October 29, 2014, the special court issued summons to T. Ananda Krishnan, Ralph Marshall, Maxis Communications Berhad, and Astro All Asia Network PLC. However, they did not comply with court orders.

The Court issued fresh summons on March 16, 2015. They did not comply with court orders.

On August 3, 2015, the Court issued fresh summons to them. However, they did not comply with Court orders.

On December 7, the Court issued fresh summons to the four accused and the special judge O. P. Saini fixed the matter for further hearing on July 11, 2016.

CBI informed the Court that the Malaysian authorities are not co-operating.

ED issues summons to Ralph Marshall

On January 23, 2016, the Enforcement Directorate issued summons to Ralph Marshall, former director of Maxis Communications Bhd. However, he has not yet complied with the ED orders.

Aircel finalises deal to sell 4G spectrum to Airtel for Rs 3,500 crore

Interestingly, Aircel promoters started process of selling the Spectrum and the equity in December. It is desperate to complete all the deals by July 2016.

On April 8, 2016, Airtel announced that it would acquire 4G Spectrum of Aircel in Tamil Nadu, Chennai, Bihar, West Bengal, J&K, Assam, North East, Andhra Pradesh and Odisha.

Bharti informed the Bombay Stock Exchange that "Bharti Airtel and its subsidiary Bharti Hexacom have entered into definitive agreements with Aircel Ltd and its subsidiaries Dishnet Wireless Ltd. and Aircel Cellular Ltd. to acquire rights to use 20 MHz of 2300 band 4G spectrum for eight circles for an aggregate consideration of Rs 3,500 crore,"

Maxis finalises deal to sell its equity in to RCOM

On June 23, Reliance Communications (RCOM) announced that RCOM and Maxis Communications Berhad and Sindya Securities and Investments Pvt. Ltd, the shareholders of Aircel Ltd expect to sign binding documentation and announce the proposed transaction of the Indian Wireless business of RCOM and Aircel shortly. This was informed to the BSE.

It is clear that Maxis wants to sell all Spectrum and stake in Aircel.

ED has attached Rs Rs 742 cr assets of Maran in the same case and filed chargesheet

On April 2, 2015, ED issued an order under the Prevention of Money Laundering Act (PMLA) for attachment of assets held by Dayanidhi Maran, his brother Kalanithi. Subsequently, Marans were charge sheeted by ED for money laundering. |