Bharti Airtel, India’s largest telecom service provider, today announced secondary sale of its 190 million shares in Bharti Infratel to Canada Pension Plan Investment Board (CPPIB) and a consortium of funds advised by KKR for about Rs 6,193.9 crore. Representing over 10.3% of total equity in Bharti Infratel, the deal has been executed at Rs 325 per share.

Bharti Airtel will use this proceed to reduce its debt. Bharti Airtel has a debt of about Rs 97,400 crore as per its financial statement for the quarter ending December 2016.

Now, its equity holding in Bharti Infratel has been reduced to 61.7%.

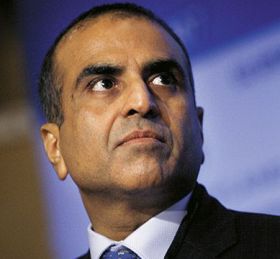

“This investment by a consortium of marquee long-term investors underlines the confidence of the global investors in India’s growth story and the government’s Digital India initiative in particular,” said Sunil Bharti Mittal, chairman of Bharti Airtel. “It further reinforces the positive outlook for the telecom infrastructure sector. The long-term investment horizon of the investors aligns well with the capital needs and business cycles of Bharti Infratel.”

This transaction makes it KKR’s second investment in Bharti Infratel. Previously, the funds managed by KKR had invested in Bharti Infratel during the period 2008 to 2015. Post this transaction, the stake held by KKR and CPPIB (combined) will be the single largest public shareholder block. |