If the entry of new players in the mobile services industry in India changed the market environment, the introduction of mobile number portability is set to further intensify the battle and customer retention will surely attain a new form of importance in business plans of operators.

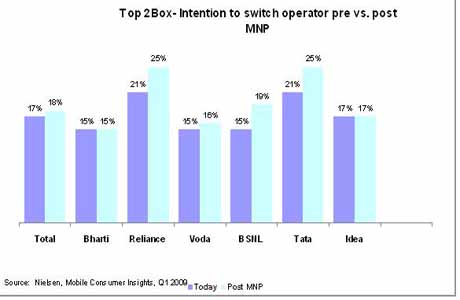

Research firm, Nielson’s new study on consumer attitudes and behaviour towards mobile operators in India, reveals that 20 % of the mobile subscribers are willing to change network if allowed to retain number which will be a possibility post implementation of Mobile Number Portability (MNP). CDMA operators Reliance Communications and Tata Indicom, who have recently launched GSM based mobile services, are likely to suffer more as 25 % of its subscribers are ready to switch over to a rival network post MNP.

BSNL follows close behind with 20 % of its subscribers also ready to change networks.

Circle-wise, Mumbai and Delhi Metro, Uttar Pradesh East and West, Gujarat, Rajasthan, Andhra Pradesh, Karnataka, Kerala, and Rest of West Bengal excluding Kolkata are most likely to witness migration of networks by the subscribers.

When viewed from the retention aspect, Chennai Metro, Haryana, Himachal Pradesh, Punjab, Uttar Pradesh East, Rest of Maharashtra (excluding Mumbai Metro), rest of Tamil Nadu (minus Chennai Metro), Bihar, and Jharkhand make it to the list.

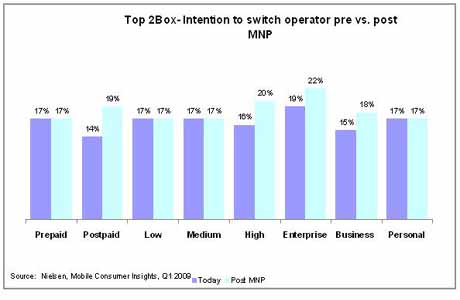

Subscriber demographics point of view, High spenders, post-paid subscribers and business subscribers show a greater tendency to switch if Mobile Number Portability is introduced while High spenders, post-paid subscribers and business subscribers show a greater tendency to switch if Mobile Number Portability is introduced.

The survey says that around 55 % of the subscribers are satisfied with their service provider and 48 % with the network quality. 43 % are satisfied with the price they pay for using mobile services. Price is the main motivator for close to 39 % subscribers while Network Quality is main driver to 36% of subscribers. Promotion, Reputation/ Recommendation and Customer Service were the other parameters taken into consideration by the mobile subscribers.

“When Mobile Number Portability was introduced in the US, price/promotions were by far the leading drivers of acquisition. Ultimately the operator who leveraged the propensity of subscribers to choose based on price/promotions was successful in riding the Mobile Number Portability wave. In India, Mobile Number Portability can be leveraged by operators through smart, targeted marketing and promotions to coincide with the introduction of the facility,” said Shankari Panchapakesan, Executive Director, Telecom Practice, The Nielsen Company, and India.

The survey covered 12,500 mobile subscribers across 50 locations in India. Aspects such as satisfaction, willingness to recommend, reasons for churn and reasons for operator selection were studied in the research. |