Alcatel-Lucent finally did what a corporate entity is mean to do i.e. creating value for its shareholders as the company for the first time in 11 quarters i.e. almost after three years posted net profit of $ 19.7 million (14 million euros). The profits are also the first for the JV since the merger. The profit though appearing to be minuscule for the organization of such a size, it assumes significance when compared to the $ 1.1 billion loss reported during corresponding quarter last year.

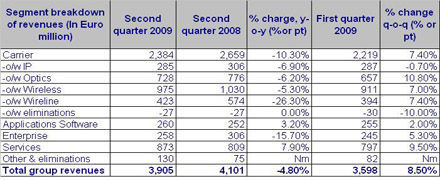

Revenues dropped by 4.8% on YoY basis to 3.91 billion euros. Operating expenses reduced by 2.3 % on a sequential basis. EPS was at $ 0.01 as compared to loss of $ 0.77 in Q2 2008 and loss of $ 0.24 in Q1 2009.

“Overall, I am pleased with the progress we have made this quarter. We announced a major co-sourcing/joint go-to-market agreement with HP. We closed the Thales transaction. Customer desire to partner with Alcatel-Lucent for next generation solutions continues to grow,” said CEO, Ben Verwaayen. “Operationally, we are seeing positive trends in our top-line, gross margin and operating expenses,” he added.

The company’s best performance came from the Asia-Pacific region with a growth rate of 9.3 % on a YoY comparison and a 32.7 % sequential growth. North America operations revenues were almost stagnant at 0.2 % growth rate. Europe and Rest of World witnessed drop of 12.8% and 12.9% respectively.

The company observed reduced revenues from the wireline business division due to fading demand for such services.

Alcatel-Lucent now expects to break-even in the second half of the current fiscal.

The company’s shares were up almost 8 percent at €1.90.

The results should come as a relief to the CEO who had been under flak for not being able to affect a turnaround of fortunes for the company ever since he took the reigns. Alcatel-Lucent is undergoing a massive cost saving exercise which includes job slashing.

The CEO said that the company will focus on co-sourcing deals similar on the lines of its deal with HP. |