The rapid popularity of domestic brands in the Indian mobile phone market continues with domestic brands collectively notching up as high as 14% market share of the overall market in fiscal year 2009-10 reveals a new research from CyberMedia’s Voice&Data. In the previous fiscal the domestic brands had a collective market share of only 3.4%.

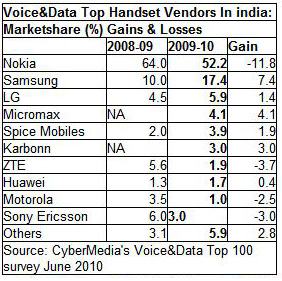

The Indian brands included Micromax (4.1% handset market share by revenue), Spice (3.9%), Karbonn (3%), Lava (1.1%), Lemon (1%) and Max (0.9%). Compared with last year, these Indian brands gained a cumulative 10 percentage points of market share in the very competitive Indian market, and Samsung gained 7 points, as Nokia lost 12 percentage points share. The handsets in question are locally branded models sourced from manufacturers in China or Taiwan.

“Low prices for perceived high-end features,” said Voice&Data chief editor Prasanto K Roy. “You get all-QWERTY Blackberry look alikes complete with trackball, and even dual-SIM phones, for Rs 5,000. We saw demand rising for dual-SIM phones last year, but the market leaders had few offerings there. And while Nokia has many low-cost models, they are relatively sparse on features.” Yet the low-cost local brands don''t beat the market-leaders in all areas, he added.

“Where they may fall short is in applications and functionality, user interface and experience, and, often, quality of construction, solidity and robustness,” Prasanto said. “But with the short life cycles of handsets today, many buyers are willing to experiment.”

The Indian mobile handset market however saw a slowed down growth last fiscal at 4.2% as compared to growth rates of 7.9% in 2008-09 and 11.9% in 2007-08.

Around 108 million mobile phones were sold in the country during 2009-10, adding up to Rs 27,000 crore in sales, up from Rs 25,910 crore the previous year.

Handset major Nokia remained the market leader with 52% share, despite a 15% revenue dip to Rs 14,100 crore (down from Rs 16,567 crore in 2008-09). The Finnish giant's share was gobbled up by the Indian-brand handsets, and by Samsung. Nokia launched 22 devices during the year, selling them though over 200,000 retail outlets across the country (with 45% in rural India), and supporting them with over 700 service centers across 400 towns and cities. But its services thrust diluted its focus on handsets.

Samsung remained the second largest handset vendor, with 17.4% market share, followed by LG at 5.9%. Sony Ericsson slipped badly last year, with very few options in the low- and mid-range handset segments.

|