When the Parliament passed the Insolvency and Bankruptcy Code (IBC), in May 2016, it was touted as the biggest reform by the Modi government. It was supposed to not only solve the problem of NPAs but also deter errant promoters from siphoning off bank loans. However, it seems that in some cases promoters may be using it to escape payment obligations.

A recent case of Educomp Infrastructure and School Management Ltd (EISML), a subsidiary of Educomp Solutions Ltd (ESL), approaching NCLT for insolvency under IBC Code raises curiosity. Shantanu Prakash, the original promoter and director of EISML and ESL, applied for insolvency as his one entity EISML could not recover dues from his other entities, mainly trusts and societies! And it is the banks who will bear the loss of thousands of crores – Rs 1,085 crore as equity investment from Educomp and Rs 800 crore of loan.

EISML has given lands and schools built by it on long lease to trusts and societies managed by Shantanu Prakash, his associates and former employees. Once the insolvency process is complete, banks will take a haircut of thousands of crores, while trusts and societies controlled and linked to Shantanu Prakash, his family, associates and former employees will continue enjoying controlling and running the schools.

It seems that EISML has been transferring its franchisee business to another company Millenium Education Management Pvt. Ltd. (MEMPL), established by Shantanu Prakash’s former employees for last few years.

Thus what will be for sale under insolvency of EISML is a shallow company.

Moreover, there is a big question mark on the legality of the whole business as CBSE bye laws do not allow Trusts/Societies to run schools as a profit making venture either directly or indirectly.

SBI-led consortium of banks has accepted 90% haircut on the debt of Rs 3,000 crore to ESL.

Mismatch between debt and revenue of EISML

ESL raised funds from banks when its share price was Rs 5,600 and market cap was Rs 10,000 crore. It pledged its shares and assets and raised funds. After raising funds, it made huge investments in subsidiaries including EISML. It invested Rs 1,085 crore (equity and preference shares) in EISML, which further raised a debt of Rs 800 crore.

On July 3, 2018, its share price was around Rs 3.1 (after split) and market cap was about Rs 37 crore.

A review of EISML’s financial statement shows a complete mismatch between its revenue and debt. In March, 2017, total loan in EISML was Rs 786 crore where as its revenue was only Rs 37 crore.

Axis Bank, Corporation Bank, SBI, PNB, Bank of India and Andhra Bank are lenders to EISML.

|

EISML: Revenue & Loans

|

| |

|

|

|

|

|

FY17

|

FY16

|

FY15

|

|

Revenue

|

37

|

47

|

71

|

|

Loans (At year end )

|

786

|

705

|

715

|

|

(Data not available FY13 & FY12)

|

|

Business Model of EISML

ESIML’s filing in BSE in 2011 while raising Rs 105 crore through non-convertible debentures states its role as:

EISML provides infrastructure services, on long term lease basis, and management solutions to various K 12 schools run by the various independent trusts and/or societies and derives its revenues mainly from two services:

- Infrastructure Services

- Management and Content Services

EISML develops and owns the school infrastructure and then leases this out to educational trusts. Under Infrastructure Services, EISML earns pre-determined yield rentals from Trusts operating schools. EISML also earns a fixed percentage share in the annual fee earned by the trust.

Monthly management fee per student is charged for providing content, Intellectual Property (IP) and Management & Maintenance services to the independent Trust and societies operating the school.

The schools being operated by EISML are branded as follows:

|

Own Brands

|

|

|

The Millennium Schools

|

K 12 schools in Tier I & Tier II cities

|

|

Takshilla Schools

|

K 12 schools in Tier III & Tier IV cities

|

|

Universal Academy schools

|

Previously Known as Vidya Prabhat schools targeted for semi urban cities.

|

How Rs 1,900 crore became NPA

After equity investment from ESL and loans from banks of Rs 1,900 crore, EISML built schools and developed infrastructure that was leased to following Trusts:

|

S.No

|

School Name

|

Trust

|

|

1

|

Takshila School, Begusarai

|

Sri Vasudeo Educational Trust

|

|

2

|

Takshila School, Gaya

|

Maurya Educational Trust

|

|

3

|

Takshila School, Muzzafarpur

|

Siya Ram Educational Trust

|

|

4

|

The Millennium School, Kurukshetra

|

Bal Shiksha Educational Trust

|

|

5

|

The Millennium School, Panipat

|

Shri Radha Raman Educational Trust

|

|

7

|

PSBB Learning Leadership Academy, Bangalore

|

Learning Leadership Foundation

|

|

8

|

The Millennium School, Indore

|

Surya Kiran Educational Trust

|

|

10

|

Takshila School Sangli

|

Maurya Educational Trust

|

|

13

|

Takshila School, Hoshiarpur

|

Maurya Educational Trust

|

|

14

|

The Millennium School, Amritsar

|

Shri Krishna Hare Educational Trust

|

|

15

|

The Millennium School, Bhatinda

|

Shri Radhe Education Trust

|

|

16

|

The Millennium School, Patiala

|

Sri Satya Sai Educational Trust

|

|

17

|

PSBB Millennium School, Chennai

|

Learning Leadership Foundation

|

|

18

|

PSBB Millennium School, Coimbatore

|

Learning Leadership Foundation

|

|

19

|

PSBB Millennium School, OMR

|

Learning Leadership Foundation

|

|

20

|

PSBB Millennium School, Pondicherry

|

Learning Leadership Foundation

|

|

21

|

The Millennium School, Lucknow

|

Education Quality Foundation of India

|

|

22

|

The Millennium School, Meerut

|

Education Quality Foundation of India

|

|

23

|

The Millennium School, Noida

|

Education Quality Foundation of India

|

Out of these at least three Trusts /Societies running eight major schools have registered offices in the same building and floor as ESL.

|

S.No

|

Particulars

|

Address

|

|

1

|

Learning Leadership Foundation

|

1208, Padma Tower-1, 5, Rajendra Place,

New Delhi 110008

|

|

2

|

Learning Links Foundation

|

1209, Padma Towers 1, 5 Rajendra Place, New Delhi – 110008

|

|

3

|

Education Quality Foundation of India

|

1210, Padma Tower-1, 5, Rajendra Place, New Delhi– 110008

|

|

4

|

Educomp Solutions Limited

|

1211, Padma Tower-1, 5, Rajendra Place, New Delhi– 110008

|

- Shantanu Prakash is founder and managing trustee of Learning Leadership Foundation, according to Educomp website. It runs five schools.

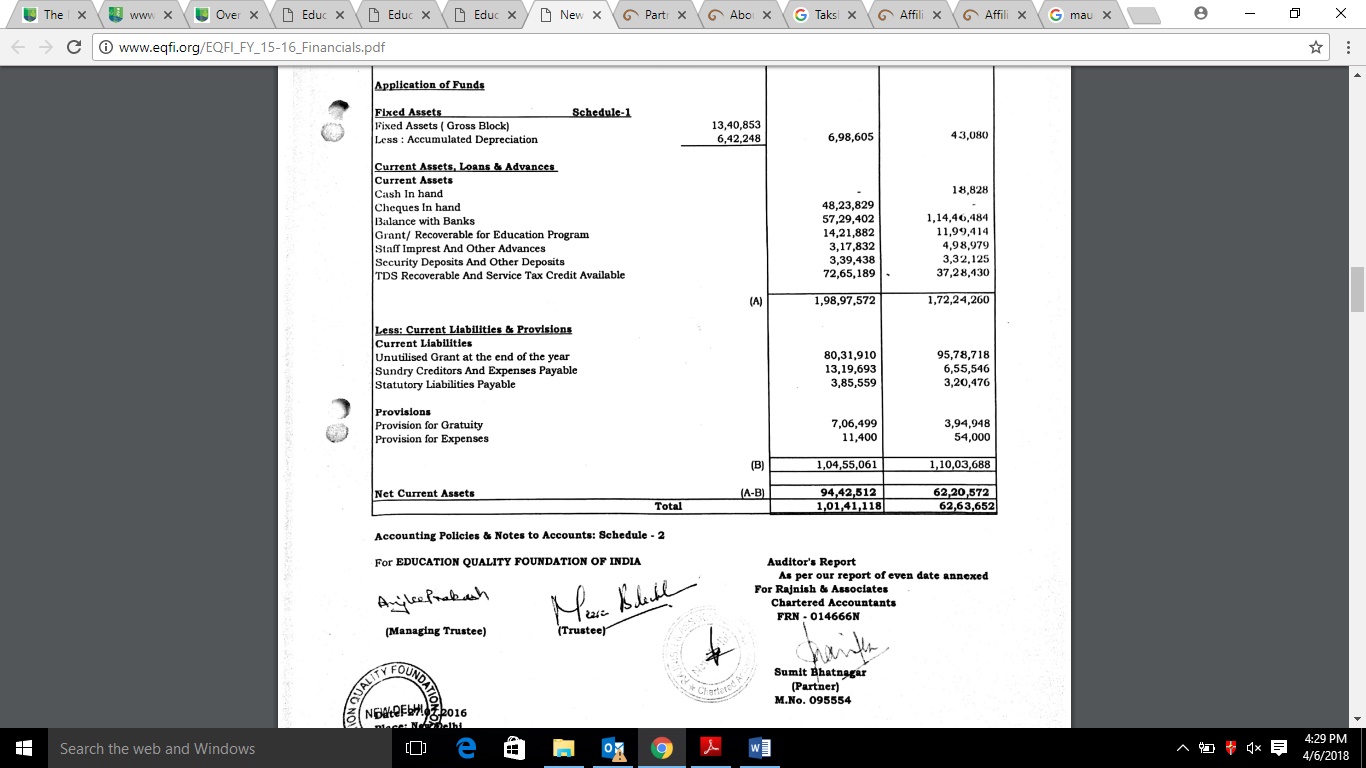

- In another Trust, Education Quality Foundation of India, Shantanu Prakash’s wife Anjali Prakash has signed the Balance Sheet as Managing Trustee.

- In its annual report for year ended March, 2016, ESL has shown most of these trusts running schools as its related parties – “directors being trustees in related trusts”.

- The original promoter of ESL Shantanu Prakash is also a member of school management committee in about 16 schools

.

EISML’s auditor report for year ended March 31, 2017 has long outstanding trade receivables of Rs 163 crore and loans of Rs 102 crore against Trusts.

In effect, EISML is a shallow company that will be put up for sale. Its substantial fixed assets like land and buildings have been locked in on long term leases of at least thirty years to Trusts that are either managed by Shantanu Prakash and his wife or by his associated and former employees.

It is obvious that either these trusts didn’t pay to EISML or terms and conditions of leases were favourable to trusts at the cost of debt-ridden EISML

In case of insolvency of EISML under IBC, it is the banks that will bear all the losses while trusts managed by Shantanu Prakash or associates and former employees will continue enjoying management of schools.

Question mark on legal validity of EISML business model

CBSE bye laws do not allow schools to be run as a profit making venture. Regulations of various states also do not permit school fee collected from students to be used for commercial activity of a trust, a company or individuals.

Relevant CBSE bye-laws are reproduced below:

Rule 19: Role of Society/Trust

19.1 (ii): It shall ensure that the school is run as a community service and not as a business and that commercialization does not take place in the school in any shape whatsoever.

19.1 (iia): Any franchisee school making payment on account of use of name, motto and logo of franchiser institution or nay other non-academic activities would be termed as commercialization of institution …

Rule 11: Fees

Rule 11.1 (i) Fees charges should commensurate with the facilities provided by the institution. Fees should normally be charged under the heads prescribed by the department of education of the state/UT for schools of different categories.

Similarly, regulations in various states do not permit commercialization of education.

These bye laws put a big question mark on the legal validity of EISML’s business model that is based earning “fixed percentage share in the annual fee earned by the schools”. Similarly, the franchisee business also comes under scrutiny.

Effective transfer of franchisee business to MEMPL

In 2014, Millenium Education Management Private Limited (MEMPL) was incorporated. Coincidentally, Millenium is common between MEMPL and The Milenium School, which is the largest chain of schools established by EISML with own brand. Bindu Rana, a former employee of ESL and a close confident of Educomp’s original promoter and chairman Shantanu Prakash was made its director.

Linked in profile of Bindu Rana shows her as a director of Educomp schools from “Jan, 2010 to Aug, 2015”. She is also founder and CEO of “MEMPL from Jan 2014 – present”. If one goes by the linkedin profile, she was serving in both EISML and MEMPL from Jan 2014 – August 2015.

Later many senior people were shifted from EISML to MEMPL.

In its filing to BSE in 2011, EISML has disclosed The Millenium Schools as its own branded schools. It seems that these schools are now managed by MEMPL or EISML has transferred branding and franchisee rights to it. If one goes to the website of any Millenium school, for example

http://www.themillenniumschools.com/tmspanipat/content/cbse-information and clicks on ‘Partner with Us’, one is transferred to MEMPL website. MEMPL website shows about 34 Millenium Schools as “Our Schools” in its website!

MEMPL also offers The Millenium Learning System, a content software developed by Educomp, to the schools.

Telecomtiger has sent questions to MEMPL, IRP for EISML, and Banks. Their responses will be incorporated in the story as and when we receive them.

|