It is a classic case of Crony Capitalism. When the government gave incumbent telecom operators (Airtel, Vodafone and Idea Cellular) natural resources such as Spectrum at administered prices (at the cost of national exchequer) and their businesses flourished, India was good. They liked calling themselves Telecom Czars. When these ‘Czars’ took bad business decisions and lost money, they again wanted the tax payers to compensate them. If the government fails to toe their line, then the NDA government will be corrupt.

Under the pressure of telecom industry, the government has constituted an Inter Ministerial Group (IMG) on telecom under Sr DDG of DoT P K Mittal to give sops to the telecom industry.

Status of the telecom industry

What was once a poster boy of India’s liberalisation, has become one of the most litigious and recently, the most leveraged industry.

EBITDA (Earnings before Interest, Tax, Depreciation and Amortization) for the entire telecom industry is approximately Rs. 65,000 Crore (annual) compared to Rs. 4.5 lakh crore of debt of the industry. Additionally, there are litigations and internecine wars all around amongst players, regulator and GOI.

Debt Conundrum: Bad business decisions

Bharti Airtel

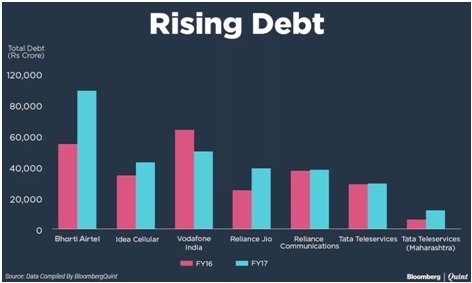

Company-wise debt data would reveal that two companies i.e. Airtel and Vodafone (soon to be Vodafone-Idea) stand out. As the graph (collated by Bloomberg Quint) suggests, Bharti Airtel has a total debt of Rs. 1 Lakh Crore, while cumulative debt of Idea Cellular and Vodafone India is another Rs. 1 Lakh Crore, thus attributing 60% of the total debt of the sector to just two companies.

Airtel’s debt is a consequence of its quest to become a world player. It acquired telecom assets from Kuwait based Zain in Africa in 2010, in a highly leveraged deal of Rs. 4, 86, 00.0 Cr, a business decision that seemed to have backfired. It was only in FY16-17 that Airtel reported a Profit before Tax of Rs. 39.6 Crore first time as against the losses of Rs. 3700 Crore it had faced a year ago in Africa. Analysis of Airtel’s balance sheets will reveal that its net debt increased from Rs. 2547 Crore to Rs 59,951 Crore (almost 2000%)between FY2010 and FY2011, the same year it bought Zain and since then it has been consistently increasing, shooting to 83,883 Crore in FY2016.

Vodafone

In the case of Vodafone, the accrual of debt has been partly due to acquisition of Indian assets and partly due to high price paid to circumvent FDI dispensation. While acquiring Hong Kong-based Hutchinson Essar, Vodafone made a highly leveraged deal of Rs. 4, 95, 00.0 Crore. Vodafone paid the ‘surrogacy cost’ of Rs. 30,000 Crore to Ruia brothers, Rs. 1,241 Crore to Analjit Singh, and Rs. 8900 Crore to Piramal Enterprises for holding Vodafone assets until 100% FDI was allowed in telecomm. Since Vodafone’s entry in India, it has invested around Rs. 83,000 Crore in India and its net debt, stood at Rs. 47,807 Crore in FY15. The relative investment to debt ratio strongly suggests leveraged nature of Vodafone’s Indian business.

Tata Teleservices & RCOM

Both Tata & RCOM have made a wrong business decisions by getting into CDMA technology in 2003, building a debt of Rs. 30, 000 Crore and 46, 000 Crore respectively. Tata, despite an infusion of Rs. 19000 Cr by NTT-DoCoMO, could not convert its operations anywhere near profitability.

Conclusion

These cases clearly highlight that massive debt of the companies has been, largely, due to bad business decisions. If poor tax payer has to compensate the rich promoters of these telecom companies for bad business decisions (which may have been taken deliberately), it would simply mean that the current NDA regime is no different from the earlier regimes and crony capitalism would continue to thrive in India, whichever government may come and go.

I would also like to point out that debt is not a barometer of the health of the industry and the operators do not deserve any sympathy.

Balanced consumer interest, adequate healthy competition, commercial interest of industry, with sound policies and regulation is the need of the hour. It should not be done at the cost of national exchequer.

(Brijendra K Syngal is former CMD of VSNL (now Tata Telecom Ltd) and a columnist of TelecomTiger. The views expressed here are solely those of the author in his private capacity) |