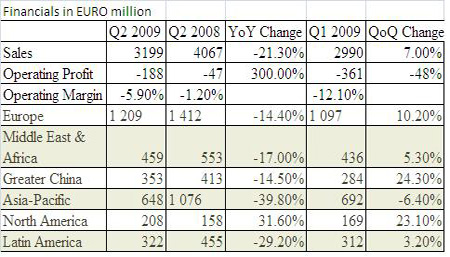

Nokia Siemens Networks (NSN) continues to be under the impact of the ongoing global slowdown in equipment spending by operators as net sales for Q2 2009 dropped by 21.3% on y-o-y basis and but is on a growth path of 7% when compared to the previous quarter.

The net sales for Q2 slid to euro 3.2 billion as compared to euro 4.067 billion in Q2 2008. NSN said that under constant currency scenario, the drop in sales would have been 20% (not much of a difference any way). In Q1 2009, the sales registered were at euro 2.99 billion.

Operating profit or rather loss increased to 188 million as compared to loss of 47 million on YoY comparison (300%). In Q1 the loss was 361 million. On a quarterly comparison the growth rate was negative 47.9 %.

Operating margin recorded a negative trend of 5.9 % as compared to -1.2 % a year ago. In Q1 2009, it was -12.1%.

For NSN the worrying fact remains that it is losing out to competitors in the APAC region. The company’s APAC sales slid by 39.8% on a yearly basis and 6.4% on a quarterly basis. In China, the drop in sales was 14.5% on a y-o-y comparison but 24.3 % growth rate from the previous quarter.

The company continues to perform strongly in the North American market. This is interesting to note because service providers in North America have hit the cost saving mode button and are cautiously investing in network upgrade.

Vendors around the world are vying against each to increase their share in the Asia Pacific region as it includes some of the highly lucrative mobile services market such as Indian and China. With drop in demand from developed markets such as North America and Europe, the importance of APAC region has only risen. NSN will have to pull itself up in the region which already witnesses growing dominance of Chinese vendors.

NSN should meanwhile find some comfort in the fact that today it won a $ 1.5 billion (euro 1.1 billion) contract from Brazilian operator Tele Norte Leste Partricipacoes SA better known as Oi.

NSN is trying to acquire more multi-year contracts through the inorganic route of acquiring bankrupt Nortel.

In India NSN’s clients include BSNL, TTSL (for GSM rollout), Vodafone Essar and Idea. But the company has not been able to acquire any contract from new entrants. Also the company has been disqualified from BSNL’s mega GSM tender. It leaves it desperately wanting for 3G to enter India because the vendor is considered as one of the formidable players in the 3G equipment landscape. |