Reliance Communications today announced its Q1 2009 financial results posting a net profit of Rs 1,637 crore or $ 342 million at a growth rate of 8.3 %. Revenues increased by 15.5 % to Rs 6,145 crore or $ 1.28 billion.

EBITDA stood at Rs 2,453 crore at 9 % growth while the EBITDA margin was at 40 % which the company says is the highest in India.

Revenues from the Global Services division grew 23.5 % to Rs 1,884 crore. Broadband division too registered impressive growth of 22.1 % in revenues while the wireless business reported a 16. % increase in revenues.

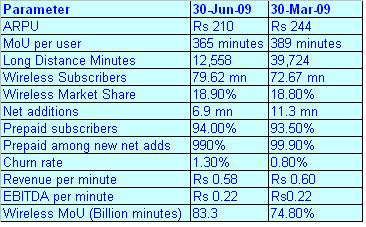

The company claimed that its market share in terms of net additions increased from 18 % to 23 % on account of its GSM foray.

“Successful commercial launch of nationwide GSM services and other new initiatives across all our businesses to drive profitable & sustainable growth at Reliance Communications,” said Anil Dhirubhai Ambani, Chairman, Reliance Communications Limited. |