The ongoing recession which has led to many unseen negative financial performance by reputed corporates saw another one as handset maker Nokia reported its first ever quarterly loss ever since it began publicly publishing its financial performance way back from 1996.

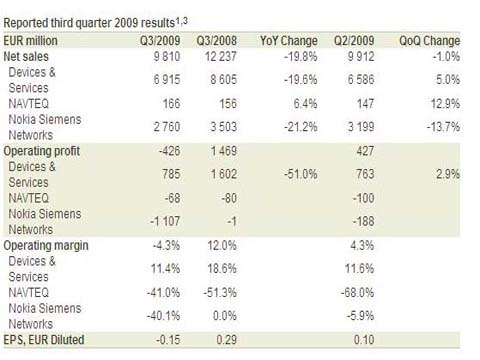

On a yoy comparison, the sales from devices and services division were down by 19.8 % from $ 12.23 billion in Q3 08 to $ 9.81 billion in Q3 09. In the preceding quarter sales were at $ 9.9 billion.

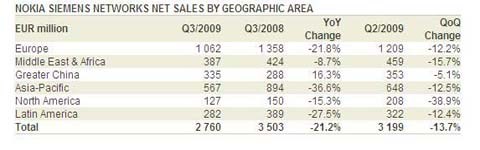

Sales from NSN were down by 21.2 % on a yearly comparison i.e. from $3.5 billion to $ 2.7 billion. Even on a quarterly basis the drop was significant as NSN had managed to clock $ 3.2 billion sales in Q2 09. NSN saw positive yoy growth in China and incidentally the most significant drop in the Asia-Pac region.

Sales of Navteq, Nokia’s location-based services business division saw appositive growth from $ 156 million in Q 3 08 to $ 166 million in Q3 09.

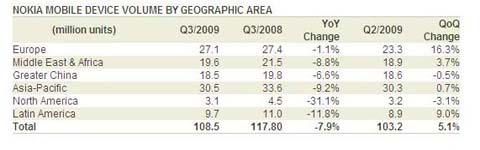

Nokia claimed to have maintained its market share in the handset segment at 38% with shipments of 108.5 million units. Even the average selling price of handset for the company remained the same at $ 62 per unit.

“The demand for mobile devices improved in many markets during Q3. With the average selling price of our devices holding firm quarter-on-quarter, our higher device volumes translated into increased net sales in our Devices & Services business. Our volumes and net sales were, however, somewhat constrained by component shortages we encountered across the portfolio. I also want to highlight the good operating expense management that helped the segment deliver solid earnings,” said Olli-Pekka Kallasvuo, Nokia CEO.

“The challenging competitive factors and market conditions in the infrastructure and related services business necessitated non-cash impairment charges at Nokia Siemens Networks. We continue to support Nokia Siemens Networks actions to improve its performance,” added the CEO probably in a effort to project that Nokia is still committed tot its alliance with Siemens.

But interestingly Nokia wrote down its goodwill stake in NSN $ 1.35 billion. This move prompted financial analysts to state that this may be the initial measures towards a possible exit from the JV. But the trouble for NSN is that even the other partner, Siemens is not keen to continue with the business in the present financial state the company is in. This would lead to a situation where the JV scouts for acquisition by some other vendor from within the industry.

“Nokia and Nokia Siemens Networks also now expect that Nokia Siemens Networks market share will decline by more than previously expected in 2009, compared with 2008. This is an update to Nokia and Nokia Siemens Networks earlier expected moderate decline. Nokia and Nokia Siemens Networks continue to see strong performance in its Services business unit expected to be offset by declines in certain product businesses,” commented the CEO.

|