While RCom maybe denying any wrong doing on its part for the alleged over reporting of revenues, the issue may gain momentum as a new analysis by Citi Group unit, Citi Investment Research and Analysis points out that even its review of the financial figures released by the firm reveals differences in revenues.

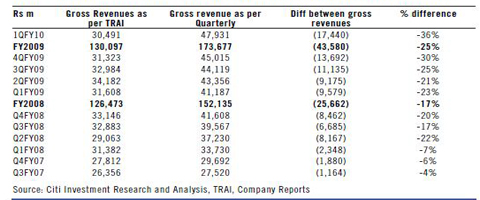

The Citi unit says that the discrepancy between the revenues provided by RCom to TRAI and those published as part of its financial performance is growing every year for the past few years. It says while the difference was Rs 2,570 crore in fiscal year 2007-08, it increased to Rs 4,360 crore in fiscal 2008-09 and further to Rs 1,740 crore in Q1 2009-10.

Fig.01 Difference between RCom's revenues figures to TRAI and quarterly figures

While RCom has been claiming the alleged over reported revenues as part of its VAS revenues, the Citi unit points out that increase in VAS revenues to this extent appears difficult.

The report says that Bharti’s reported revenues from wireless services are higher than that included under the audited financial results. This is because the audited results included revenues from fixedline services as well.

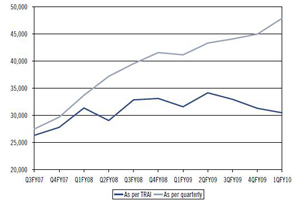

Fig.02 Gap between revenues reported to TRAI and quarterly figures

The Citi study also doubts the company on the issue of sale of debtors amounting to Rs 617 million to four entities namely Neptune Steel Strips Ltd., Shriyam Autofin Ltd., Mahima Mercantile Credit Ltd. and Traitrya Construction Fin Ltd.

“Though the sale may have happened at a big discount to the bill value, the ability of these companies to take on (from a funding perspective) and recover the debtors which were earlier written off, is questionable to us, especially if they pertained to the handset bundled schemes launched 4-5 years back (Monsoon Hungama). Since this is based on our interpretation of this reconciliation item, we await further clarity from the company on this and the other issues,” says the report.

The study also questions the logic presented by RCom that sale of expired prepaid cards totaled Rs 380 million. According to Citi it is unusual because those were not of any use and still RCom subsidiary, Macronet purchased them.

It also finds The Capital work-in-progress on the higher side.

Fig.03 Figures of Bharti Airtel

|