With falling revenues the cellular companies are looking at means of cutting costs. The growing capital expenditure and the high operating expenses incurred by each telecom operator on a site ownership basis individually, is driving operators to consider the sharing of infrastructure.

Sharing of infrastructure can lead to several benefits. Operators resorting to infrastructure sharing would reduce their payback time significantly by reducing both their operating expenditure and capital expenditure.

Infrastructure sharing can be used in both the start-up phase to build coverage quickly or longer term, to build more cost effective coverage in rural areas. Sharing arrangements provide the highest savings in cases of low traffic demand and more efficiency is achieved by pooling resources.

For new telecom companies such infrastructure sharing will mean not just faster roll out but also saving of billions of dollars. To set up every telecom towers it costs between Rs 20 lakhs to 25 lakhs and for a pan-India rollout - a player may need upto 10,000 towers. Thus the savings could be as high as Rs 2500 crores. For the existing telecom companies investing in towers for the last 10 years, earnings from rentals could be Rs of 25,000 per tower per month.

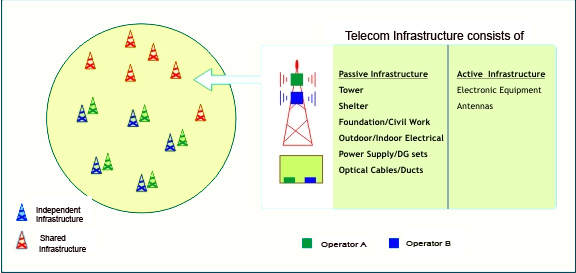

Sharing can be broadly classified into two groups:

- Passive Elements Sharing

- Active Elements

Passive Elements Sharing typically involves sharing the site and mast for antenna placement. In addition to this, the power equipment, transmission equipment and antennas can be shared among operators. Passive Elements Sharing provides cost savings for site acquisition, civil works, annual site rent, transmission and operational costs for running the site. Site acquisition and site preparation represent a large part of the network rollout costs, about 20% of expenses. Site Sharing can be handled on a site-by-site basis or can be combined with a coordinated rollout plan, allowing additional savings on network planning, civil works and operation. A Site Sharing arrangement can be handled directly between operators or may include a tower company or other partner. Site Sharing is suitable for densely populated areas with limited availability and expensive sites, and rural areas with high costs for transmission and power. License regulators usually promote Site Sharing in order to reduce the environmental impact antennas have on views and to allow new operators to build their networks by re-using existing sites.

In the case of active network sharing, two or more operators deploy a completely shared radio network and in some case, a partly shared Core Network. The shared radio network consists of Radio Base Stations, Radio Network Controllers, transmission, site etc. The part of the core network that is shared consists of the MSC/VLR and SGSN.

Active sharing is not allowed by regulation in most of the countries and has to be initiated amongst the operators themselves.

Service providers are already sharing infrastructure at their own initiative selectively. According to industry estimates as of August 2007, Bharti had 40,000 towers, Vodafone had 20,000, RCOM has 14000, Idea owned almost 10,000 towers and Tata Teleservices Maharashtra had 1,207 towers - 418 BTSes in Mumbai and 789 towers in RoM. The available information suggests that about 25% tower sites are already shared for passive infrastructure only. This too is predominantly in rural areas and small towns. Spice has been particularly active in relying on tower companies. It has signed with GTL for towers to be built on build operate and lease basis in Punjab and Karnataka. Bharti has been sharing 30% of its towers with Vodafone and Idea. Recently, RCL itself announced an agreement to share ‘passive infrastructure’ with Hutchison and Idea Cellular. |