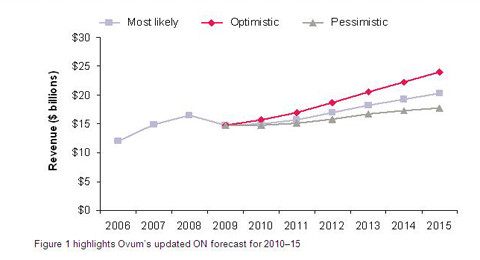

Market research firm Ovum projected an upbeat long-term forecast for sales of optical networking (ON) equipment, driven by the continuing need for bandwidth. According to Ovum, the global ON market is expected to reach $ 20 billion by 2015 with a CAGR of 5%.

“Based on the research, EMEA’s results are expected to turn positive in 2011. North America and Asia-Pacific will be enough to start the global turnaround in 2010, which will gain momentum in 2011 as EMEA transitions to positive growth. Asia-Pacific is now the number one region for ON sales, driven by a mobilizing China”, said Ian Redpath, Principal Analyst.

The top six vendors in terms of revenues in the APAC region include Huawei with a market share of 43%, ZTE with 16%, Alcatel-Lucent with 9%, NEC with 7%, FiberHome and ECI with 4% each.

The big driver in the region continues to be China. Japan has completely flattened out and has been overtaken by India. In China, the mobile market is the major investment driver both for cell tower connectivity and the backbone core. Ovum expects this trend to continue for the foreseeable future.

Ovum’s view is that a second application wave will be needed to support high ON growth rates in the future. That second application wave for China could be enterprise Ethernet services. China has a modest level of enterprise Ethernet penetration so far. Global corporations that have operations in China desire high-speed Ethernet connections. To accommodate them, global carriers are adding more mainland China gateway cities to their networks.

“China Telecom is currently evaluating a carrier Ethernet transport solution for its next-generation network upgrade. Enterprise Ethernet is poised to add to the bandwidth requirements of the optical network core within China”, adds Redpath, based in Canada.

Japan is overdue for a network refresh. ON funding has been subsisting at 2003 levels. The capex squeeze can only continue for so long before the bandwidth fundamentals necessitate a fresh round of network upgrading.

While Japan has stagnated, India has grown; overtaking Japan for the number two spot within Asia-Pacific. The Indian ON market has outside-in drivers from global corporations that want to do more business in India and require high-speed telecom service connections. The global carriers are responding with expanded PoPs in India and capacity into and out of India. Domestic players BSNL, Tata, and Reliance Globalcom are also growing their internal and global profiles.

|