Indian mobile services market has always been price sensitive. The trigger for the uptake of mobile services in India at regular intervals has always been the price card played by operators. A new tariff plan announced by a particular player was quickly bettered by competitors within no time. Some of the revolutionary tariff plans include RCom’s Monsoon Dhamaka, BSNL’s One India plan and the lifetime plans introduced by private operators.

But Reliance Communications, ‘Simply Reliance Plan’ which the operator introduced to challenge competition is gaining attention for altogether different reasons. None of the competitors has come forward to challenge RCom. But investors have already become apprehensive and are infact queuing up to exit the sector as they fear that telcos will not be able to sustain the prevailing profit margins forget about improving it thereby denting a blow to profitability.

What started yesterday with investors in the stock exchanges showing thumbs down for the competitive tariffs announced by RCom continued today as well with all the listed operators reporting significant drop in valuations.

Compiled by: TelecomTiger

Bharti and RCom both reported more than 10 % drop in share prices. The situation was so severe that Bharti Chairman Sunil Mittal stated in Geneva that RCom’s tariff was unsustainable in long run and others will not follow the price model. But even this statement failed to keep a check on investor apprehensions.

RCom meanwhile stated that it is hopeful that overall revenues will remain at the same level and the main objective in introducing the plan was to attract new subscribers to its fold. It also said that it expected minutes of usage to increase post introduction of the new plan.

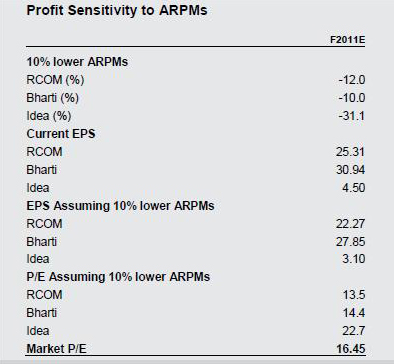

Morgan Stanley in its report and analysis on the tariff plan states that the new tariff plan will act as a big barrier to the new entrants as they will find difficult to position their services amidst such competitive market forces. The report further states that while other operators are expected to keep away from such a model the introduction of the plan itself may lead to investors de-rating the Indian telecom sector. The report states that end consumers are the only segment which stands to be benefited from the move.

Source: Morgan Stanley

As per Morgan Stanley, revenues in the industry will remain stagnant for the next 12 months.

The impact of RCom’s new plan is that the effective tariff for the plan will be 36 paise per minute for voice services, says Morgan Stanley. This figure is 29 % lower than industry average revenue per minute (ARPM) of 52 paise per minute for voice services as on June’09. With data revenues the total revenue is estimated to be 42 paise per minute as compared to industry average of 58 paise per minute. The average cost per minute is 40 paise per minute for operators. For RCom to sustain this plan, it should either have a lower-than-industry average for cost (Morgan Stanley claims RCom has average cost of 35 paise) and more importantly be able to further reduce the cost. Otherwise it will end up with only wafer thin margins in the long-run.

The government too stands to lose out if the overall revenues of telcos decline as the annual licence fee is directly proportional to the revenues earned.

The ‘Simply Reliance Plan’ appears to be not that simple for the industry. |