The financial results announced by Aditya Birla Group owned Idea Cellular for Q2 2009-10 reflect the kind of trends to expect from other telcos who all find themselves horribly engaged in tariff war which is not serving well for any of them atleast financially.

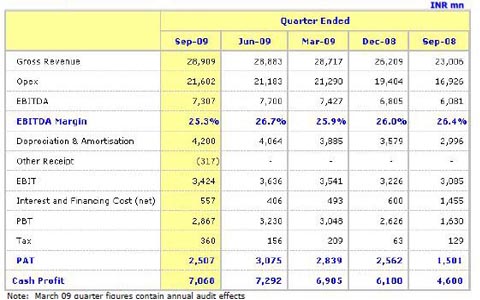

Though Idea’s performance is on a positive mode when compared on a yoy basis, the performance appears disappointing when compared on a sequential basis. The comparison on sequential basis is important in this case because most of the tariff changes have happened in the July-September quarter and comparison on qoq gives an idea of the impact of the new subscribers on the overall financial performance.

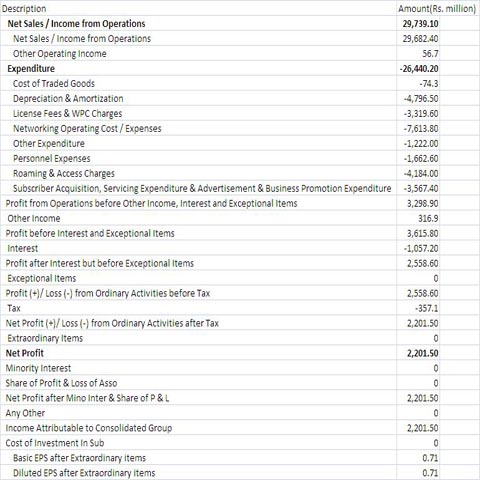

While Idea’s net profit is seen on a positive trajectory from Rs 144 crore in Sep’08 to Rs 220.1 crore in Sep’09 at a 52 % rise, the same are 26 % down when compared to around Rs 290 crore profit recorded in March’09. This even as the company added 4 million new subscribers during the quarter.

Revenues for the quarter were Rs 2973.9 crore as compared to Rs 2303.3 crore last year and Rs 28,883 crore on March’09.

Average realised rate (ARR) dropped down to 0.56 paise per minute as compared to 0.58 paise in march’09 and 0.62 in Sep’08. ARPU slid to Rs 209 from Rs 232 in March’09 and Rs 263 in Sep’08.

The VAS contribution increased to 10.1% during the quarter. But another alarming aspect is that the blended churn increased to 7.2% from 3.9% in Sep’08.

“The bubble days of 2007-08 had blurred the distinction between the real and the fanciful in the Indian mobile sector. The resultant overcapacity has manifested in tariffs unrelated to economics. Market prices have plumbed depths which predicate that the market itself will eventually work the overcapacity out of the sector,” said the company.

“The Indian market has been characterised by high multiple SIM usage. This phenomenon has now proliferated with the availability of the Dual-SIM device, priced under Rs. 20, which facilitates the simultaneous use of dual-SIMs on the handset. An estimated 20% of all India subscribers are currently using multiple SIMs, the proportion being higher in urban areas. Such consumers are inclined to retain their original subscription for better coverage, service, and reliability considerations, but selectively pursue price arbitrage for outgoing calls. This phenomenon is causing a realignment of competitive tariff structures. Popular subscriber based metrics like ARPU and churn lose relevance, and give way to more orthodox metrics.”

While it has become easier to grab traffic through cut pricing, by the same token, such traffic can flow away with the same facility. The multiple SIM phenomenon, timed as it comes together with sector overcapacity, will accelerate the impending shake-out of the sector overcapacity,” added the company. |